The word “asset valuation” refers to the procedure of estimating the worth of something. Shares, real estate, and cash are just few of the many possible asset types for Self-Managed Super Funds (SMSFs). Market changes, firm performance, and other external variables can all affect the value of these assets. Trustee of a self-managed superannuation fund (SMSF) should regularly assess fund assets to ensure that the fund’s financial statements accurately represent the value of the fund’s investments. Since June 30th is both the end of the SMSF financial year and the deadline for reporting asset values to the Australian Taxation Office, this is when most SMSFs conduct their annual asset valuations (ATO).

Table of Contents

Why do assets need to be valued?

To comply with Regulation 8.02B of the Superannuation Industry (Supervision) Regulations 1994 (SISR). A key component to creating meaningful SMSF financial reports is figuring out how much an asset is worth. It has an effect on the returns for members and, in the end, on the performance of the SMSF sector.

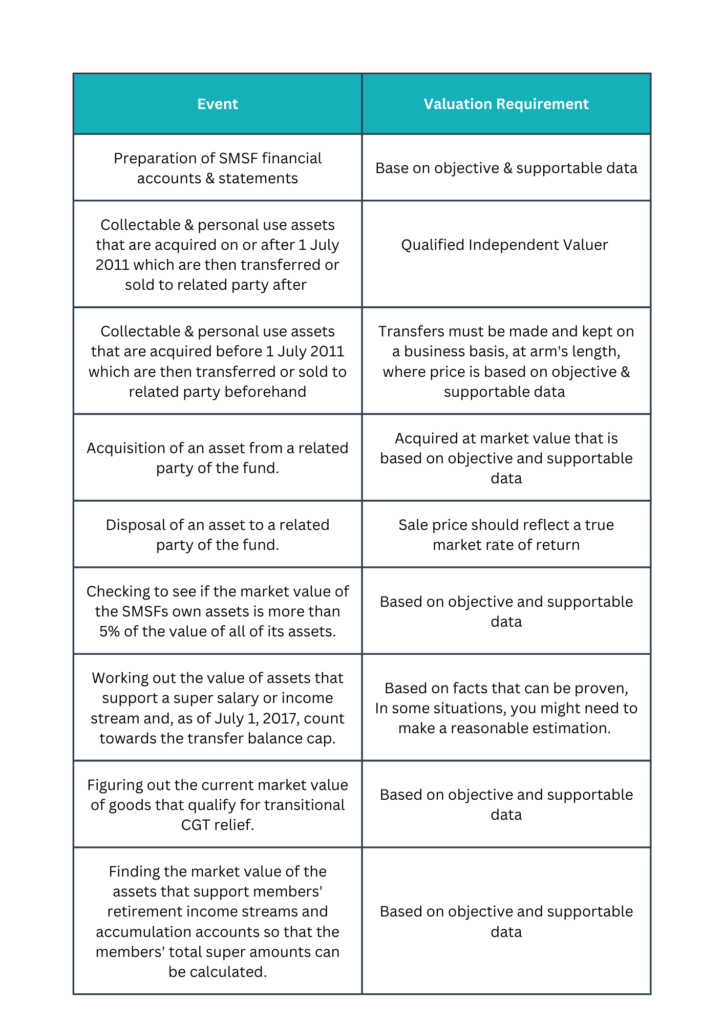

A valuation of your assets is needed to make sure that your SMSF has followed all relevant super laws for:

- putting together the fund’s financial statements and accounts,

- buying assets between SMSFs and related parties, (s66 of SISA)

- making and keeping investments on an arm’s length basis (s109 of SISA)

- Disposing some collectibles and personal use assets to a related party of the fund.

- Figuring out the market value of an SMSF’s in-house assets as a percentage of all assets in the fund.

- Commencing a pension under Reg 6.17

- Determining the value of existing retirement income streams at 1 July 2017 because they will be counted towards the transfer balance cap.

- Identifying the market value of assets that are eligible for transitional capital gains tax (CGT) relief in the 2016–17 income year.

- Determining the market value of assets supporting members’ retirement.

Who can value the assets

Managing a Self-Managed Super Fund (SMSF) can have major effects on the fund’s financial statements and tax liabilities. Therefore, the Australian Taxation Office (ATO) requires trustees of self-managed super funds (SMSFs) to ensure that their funds’ assets are evaluated at market value using reliable and objective data. This necessitates the values to be founded on solid evidence and accurately reflect the state of the market at the time.

SMSF trustees may choose to conduct their own asset valuations, but if they do so, they must be impartial and well-justified. The ATO offers guidelines on how to evaluate assets held in SMSFs, such as when to bring in independent valuers for high-value items like art and cars.

In all instances, the person doing the valuation must use data that is fair, and supportable. Depending on the circumstances, an appraisal may be done by:

- A registered valuer

- A professional who provides valuation services and is a member of a professional valuation group.

- A person with no formal valuation qualifications but has experience or knowledge in a certain area.

When it comes to figuring out what an independent valuer is, this means that the valuer should not be a member of the fund or someone who is connected to the fund (like a relative). They should be fair and not be swayed by other people or make it look like they are. You shouldn’t count on an independent valuation if it has become significantly wrong or if the value of the asset has changed a lot since the last time it was valued.

In this case, we suggest that you get a new valuer or use other types of evidence to back up your estimate of the asset’s market value. As part of their audit and guarantee work, an approved SMSF auditor can also ask for a third party to value the fund’s investments.

In conclusion, valuing assets in a self-managed super fund is an essential part of operating such a fund. For certain types of assets, SMSF trustees may choose to use the services of independent valuers to ensure that the valuations are fair and defensible. Independent valuations may be requested by SMSF auditors as part of the annual audit process. By following these procedures, SMSF trustees can prevent any potential delays or follow-up actions from the ATO and guarantee that their fund’s financial statements accurately reflect the value of their interests.

How do you know when you need a qualified valuer?

Not every situation requires you to have an independent valuer so how do you know when you need one?

In accordance with the super law, you only need a qualified independent valuer in the following circumstances:

- from 1 July 2011 for any collectables and personal use assets that were acquired on or after 1 July 2011 and disposed of to a related party

- from 1 July 2016 for any collectables or personal use assets that were acquired by the SMSF before 1 July 2011 and disposed of to a related party after 30 June 2016.

Care is needed when it comes to valuation as stated by Belinda Aisbett

Belinda Aisbett, director of Super Sphere, told attendees at the Institute of Financial Professionals Conference 2023, “Online valuation tools may be helpful, but they may not be very helpful. It can be difficult to know what to give your auditor, but if you’re unsure, ask your auditor.”

In addition, if an online valuation service provides a residential property valuation within a price range, the size of that range will also determine the service’s credibility, she noted.

“For instance, if the value of an item falls between $750,000 and $1,250,000, the auditor will not examine it. “The range is too large,” she remarked.

She indicated that, as an auditor, she would favour a physical valuation performed by a real estate agent who has actually inspected the property over a computer-calculated valuation.

In addition, she highlighted that council rates notices cannot be used as the premise for residential property valuations.

Contact Us

At Mint Super Audit, we know how crucial precise asset valuations are for SMSF reporting, especially at the year’s end. We place great dedication to educate the SMSF trustees, and lay special emphasis on meeting the needs of our clients in the area of SMSF audits. Below , you’ll find a selection of additional reading materials that will help you learn more about this issue. Contact us today if you have any enquiries or would like more information about our SMSF audit services. We appreciate you thinking of Mint Super Audits for your SMSF requirements.

Other related sources: